Banks & Credit Unions - Safeguarding the Economy and Combating Counterfeit Money Sale

Introduction

In the world of finance, Banks & Credit Unions hold a pivotal role in safeguarding the economy by ensuring the legitimate flow of money. They act as trusted institutions that individuals and businesses rely on for various financial services. From managing savings and offering loans to providing secure payment systems, banks play a crucial role in society.

What are Banks & Credit Unions?

Banks and credit unions are financial institutions that facilitate transactions, store money, and provide various financial services. While banks are usually for-profit establishments, credit unions are non-profit organizations owned by their members. Both types of institutions serve the public, acting as the backbone of financial stability.

Safeguarding Financial Transactions

Banks & Credit Unions prioritize the security and integrity of financial transactions. They employ robust technology and stringent protocols to ensure that funds are transferred securely and confidentially. This commitment to secure transactions helps protect individuals and businesses from the risks associated with counterfeit money sale.

The Risks of Counterfeit Money Sale

Counterfeit money poses a significant threat to the economy and individuals' finances. Fraudsters can create seemingly authentic bills, making it challenging for the average person to identify fake currency. Engaging in counterfeit money sale operations can lead to severe consequences, including legal repercussions and financial loss. This is where the role of banks becomes crucial in combatting these illicit activities.

How Banks Combat Counterfeit Money Sale

Banks employ a wide range of measures to combat counterfeit money sale and protect their customers. Some of the strategies include:

1. Sophisticated Security Features

Modern banknotes are designed with advanced security features that make them difficult to counterfeit. These features can range from watermarks and holograms to unique serial numbers and special inks. Banks continuously update and improve these security measures to address emerging counterfeiting techniques.

2. Employee Training

Banks invest heavily in employee training to enhance their ability to detect counterfeit money. Staff members undergo rigorous training programs to become familiar with various security features, enabling them to recognize and report any suspicious activity or counterfeit bills.

3. Collaboration with Law Enforcement

Banks actively collaborate with law enforcement agencies to share information and support investigations related to counterfeit money circulation. This collaboration helps in identifying and apprehending individuals involved in counterfeit money networks, ensuring the safety of the financial system.

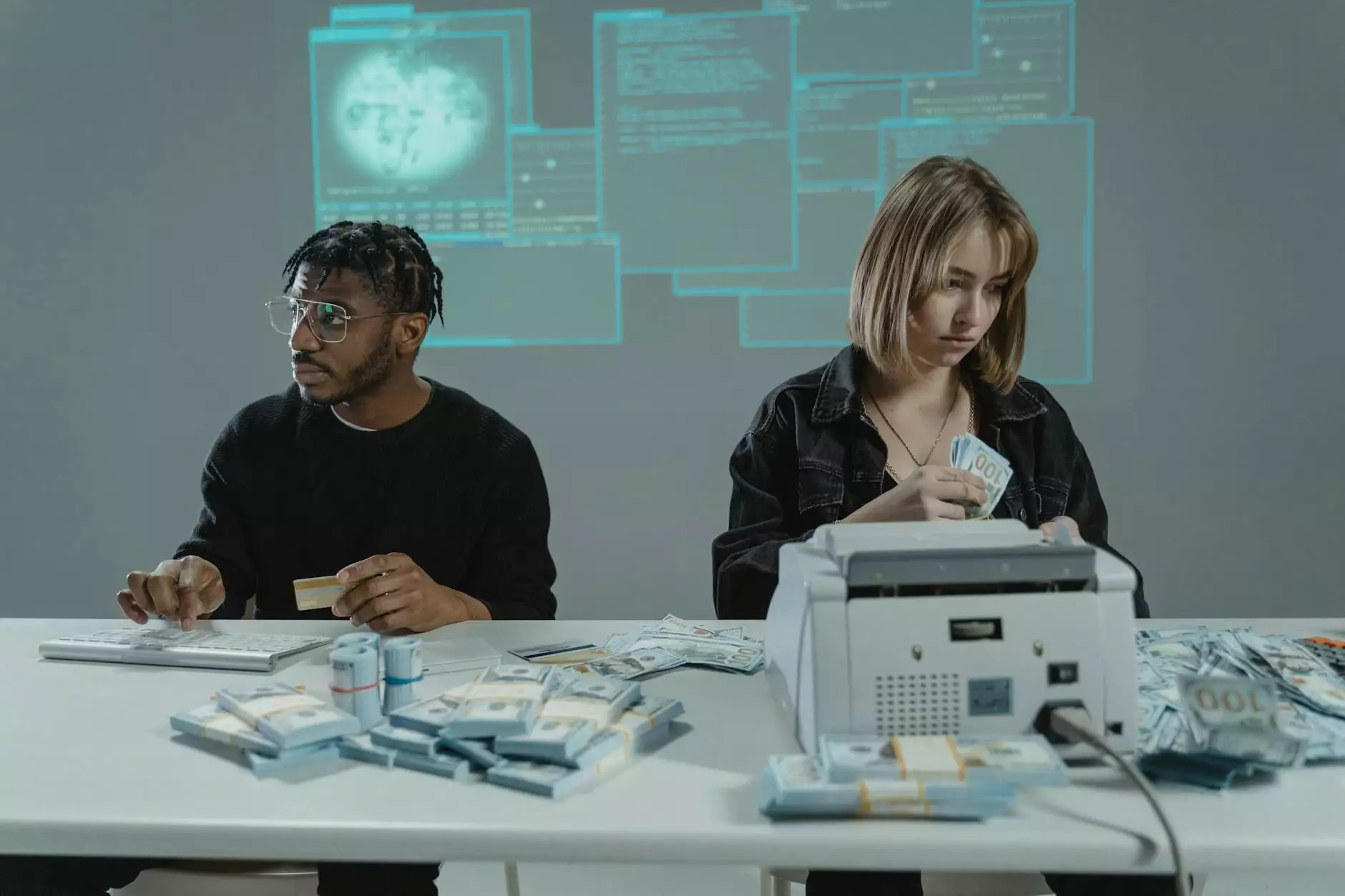

4. Detection Technology

Banks utilize specialized detection technology, such as automated currency scanners, to identify counterfeit money quickly. These tools utilize advanced algorithms to analyze banknote features and authenticate bills accurately.

5. Public Awareness Campaigns

Banks run public awareness campaigns to educate individuals and businesses about the risks of counterfeit money. These campaigns aim to raise awareness about the security features of legitimate currency and provide guidelines on how to identify and handle counterfeit bills.

Conclusion

Banks & Credit Unions play a vital role in maintaining the stability and integrity of the economy. Their tireless efforts to combat counterfeit money sale help protect individuals, businesses, and the broader financial system from the risks associated with counterfeit currency. By continuously evolving their security measures, investing in training, cooperating with law enforcement, and raising public awareness, banks contribute to a secure financial environment for all.

Disclaimer: This article is intended for informational purposes only and does not constitute legal or financial advice. Consult with a professional for specific guidance related to your situation.